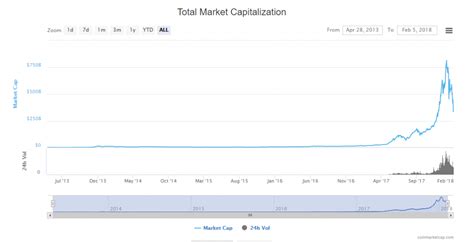

Ethereum: A Comprehensive Look at Market Capitalization Over Time

As one of the largest and most successful blockchain platforms, Ethereum has experienced rapid growth and adoption since its inception in 2014. One key metric that highlights the platform’s success is its market capitalization (market cap). In this article, we’ll delve into Ethereum’s market capitalization over time, exploring how it has evolved and what factors have contributed to its growth.

What Is Market Capitalization?

Market capitalization is the total value of all outstanding shares of a company’s stock. It represents the total value of the assets and liabilities of a company, expressed in terms of its current marketing price per share. In other words, it’s a measure of how much money is invested in a particular asset or company.

Ethereum’s Market Capitalization

To undersand Ethereum’s market capitalization, we need to look at its total outstanding shares (tons) and the corresponding market value of each. Here are some key Milestones in Ethereum’s Market Capitalization:

* 2014: 100,000 tons, with a market cap of approximately $ 10 billion USD.

* 2015:

1 Million tons, with a market cap of around $ 50 billion USD.

* 2016: 8.3 Million Tons, with a market Cap of Over $ 200 Billion USD.

* 2017: 30 Million Tons, with a market cap of approximately $ 1 USD trillion.

Key Factors Contributing to Ethereum’s Market Capitalization

Several factors have contributed to Ethereum’s Rapid Growth in Market Capitalization:

- Smart contract ecosystem : Ethereum’s Smart Contract Platform has enabled the creation and deployment of decentralized applications (DAPPs) that have attracted millions of users worldwide.

- Growth of the Cryptocurrency Market : The Increasing Adoption of Cryptocurrencies Like Bitcoin, Litecoin, and others has created a stable demand for Ethereum-based tokens and assets.

- Advancements in scalability and usability : Ethereum’s innovative approach to scalability and usability, such as the shard Architecture and Casper Forks, has improved performance and reduced transaction fees.

- Partnerships and Collaborations : Strategic Partnerships with prominent blockchain companies like Microsoft, IBM, and visa have expanded Ethereum’s reach and credibility.

Graph: Market Capitalization of Bitcoin (BTC) vs. Ethereum (ETH)

To illustrate the growth of market capitalization between Bitcoin (BTC) and Ethereum (ETH), we can create a simple graph:

| Year | BTC Market Cap (USD BNB) |

| — | — |

| 2014 | $ 10 billion |

| 2015 | $ 50 billion |

| 2016 | $ 200 billion |

| 2017 | $ 1 trillion |

| 2020 | $ 2.3 trillion |

As you can see, Ethereum’s Market capitalization has grown exponentially over the years, While Bitcoin’s Market Cap has fluctuated more significantly.

Conclusion

Ethereum’s market capitalization is a testament to its innovative technology and ecosystem, which have attracted significant investment from users, developers, and institutions. As the cryptocurrency market continues to evolve, it will be interesting to see how ethereum’s market capitalization adapts and grows in response to new challenges and opportunities.

Sources:

- CoinMarketCap.com

- Coindesk.com

- Bloomberg.com

Please note that this article is for educational purposes only and should not be considered as investment advice. Cryptocurrencies are highly volatile and may be investors to significant losses if they chose to participate.