Here is a comprehensive article on “Crypto,” “IDO,” “Stablecoin,” and “Exchange Rate Risk”:

“Crypto IDO Stables in the Wild West: Understanding the Risks and Opportunities in the Cryptocurrency Market”

The cryptocurrency market has seen significant growth over the past decade, with new projects and companies emerging every day. One of the most exciting and fastest-growing areas within this ecosystem is Initial Coin Offerings (IDOs), which refers to the process of launching and listing new cryptocurrencies on online exchanges.

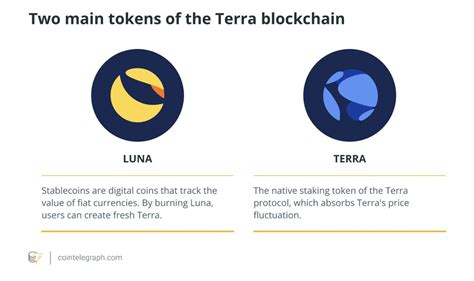

One of the key players in the IDO space is the Stablecoin, a type of digital currency that is pegged to a traditional asset, such as the US dollar. Stablecoins have gained popularity due to their potential for price stability and ease of use. However, they also come with risks, including exchange rate risk.

Exchange rate risk

One of the most significant concerns when it comes to investing in cryptocurrency is exchange rate risk. This occurs when the value of a cryptocurrency token or coin fluctuates in response to changing market conditions. For example, if an investor buys Bitcoin (BTC) and later sells it at a higher price, they may make a profit.

However, if the buyer decides to sell their Bitcoin at a lower price, they may suffer losses due to the decline in the value of the token. This can happen for a number of reasons, including:

- Market volatility: Cryptocurrency prices can be very volatile, with significant swings occurring quickly.

- Liquidity issues: Some cryptocurrencies have limited liquidity on online exchanges, making it difficult to buy and sell them quickly.

- Regulatory uncertainty: Governments and regulators may impose restrictions or regulations on certain types of cryptocurrency trading, leading to market instability.

Stablecoins and Exchange Rate Risk

Stablecoins are designed to mitigate exchange rate risk by tying their value to a stable asset. However, this also means that they can be sensitive to changes in the value of the underlying asset. For example:

- If an investor buys Stablecoin X for US dollars and later decides to convert it back to US dollars, the value of Stablecoin X may not immediately increase or decrease.

- If there is a sudden drop in the value of the stable asset used as collateral for the Stablecoin, the value of the Stablecoin may also decrease.

IDOs and Stablecoins

The IDO space has seen significant growth in recent years, with new projects launching on online exchanges every day. Some notable examples include:

- Aave: A decentralized lending protocol that allows users to borrow and lend cryptocurrencies.

- MakerDAO: A decentralized stablecoin protocol that uses a consensus proof-of-stake algorithm.

- Compound: A decentralized exchange (DEX) that offers interest-bearing tokens.

However, the IDO space also comes with risks, including market volatility and regulatory uncertainty. Some of these risks include:

- Market manipulation: Investors may attempt to manipulate cryptocurrency prices by buying or selling assets in large quantities.

- Regulatory risks: Governments and regulators may impose restrictions on certain types of cryptocurrency trading, leading to market instability.

Conclusion

The world of cryptocurrency is complex and rapidly evolving, with new risks and opportunities emerging every day. While stablecoins offer a potential solution to exchange rate risk, they also come with their own set of challenges. IDO projects can be exciting investments, but investors should be aware of the potential risks. By understanding these risks and taking steps to mitigate them, investors can make informed decisions about where to invest in the cryptocurrency market.